|

|

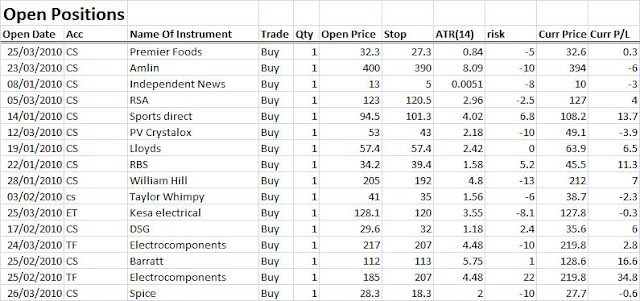

Firstly here is a summary of my open positions.

I closed my position in ARM holdings out this week manually. I did this to free up some resource for trading in one of my accounts. However this broke my rule of never clicking the buy or sell button and I have paid the price for it. As soon as I clicked the sell button the price continued to rise and has done so ever since. So far I have lost out on a further 7 points and who knows how much more potentially. I am not going to rush back into the position because of this. In the past I have done this and it’s a sure fire way to lose money. The fact is I took a £30 profit manually when I should’ve been trailing my stop at my 3ATR range and let the position stop out when the current uptrend movement is over. I will not be making this mistake again.

Anyway moving on. I opened two new trades this week. One in Kesa Electricals and the other in Spice.

Kesa Electricals

If you take a look at the chart Kesa is a shodow of its former self at 127.8 down from highs around 370 in 2007. It has recently rallied from 111 and at the moment is pausing for breath before re-aserting itself to the upward movement once more. I could be wrong of course but this stock fits with my 1% risk strategy and has potential for a good return. I have gone long at £1 per point at a price of 128.1 with a stop set at 120. I will need to monitor this position closely as it has failed to break through the most recent high to return to the uptrend. If the stock starts to fall back it may be wise to move my stop in closer end exit the bet early.

Spice

Spice has dropped considerably since October 2009. It has an all time low level of 24.198 set in September 2004. I suspect this level could act as potential support for this stock. A resistance level is a level at which a price drops to and immediatley bouces back up from. With the stock falling a further 6% on friday I decided to go long at £1 per point. I brought in at 28.3 with a stop set at 18.3. This is well below the potential support price of 24.198. As soon as any of my positions start to move into profit I start to move my stop up by 2ATR of price to break even then by 3or4ATR of price to give the position room to breath. I used to move all positions by 3ATR after break even but I have felt lately that for some positions this has been too close and I have been stopped out prematurely. Therefore on some postions I have decided to allow 4ATR as a stop distance. I will give this strategy more time to see if it works well. If I feel I am still being stopped out too soon I may look to trail my stops as a percentage of price say 10% or 15%. I know people who employ this strategy and it seems to have worked very well for them.

You may have noticed that I have opened a new position in premier foods. My old position stopped out at 33.1 for a 1.30 loss on the 10th March. I still believe this stock has great potential so I have brought back in at the better price of 32.3. This is a very small risk bet with my stop set at 29. So only 3.3pts risk. I could’ve gone more than £1 per point on this bet with and still achieved my 1% risk target. I could’ve gone £3 per point which would be £9.9 risk however, I decided not too. I have decided to stick with a maximum of £1 per point on all bets now untill I recoup my losses. I was nearly back to break even at the beginning of the year and started to bet more than £1 per point on stocks with a disastarous effect. I lost about £400 in a month and since then I have decided that sticking at £1 per point untill I learn more about what I am doing is fine with me. The good thing is if I make £30 profit on my premier foods position this will be nearly at 10:1 reward to risk ratio. I aim for a minimum of 3:1 reward to risk so 10:1 would be excellent. If only all my positions return 10:1 I would be laughing. You never know it could happen.

Anyway I have some more orders that I have placed this week which I will list below. An explination behind them will have to wait untill I have more time.

Aberdeen Asset Management £1 per point Buy, 123, stop 113

F&C asset management £1 per point Buy, 59, stop 49

SIG, £1 per point Buy, 114, stop 104

Luminar £1 per point Buy, 45, Stop 35

E2V technologies £1 per point Buy, 39, stop 29

As always if you have any questions please feel free to e-mail me.

I am also in the process of writing a book about Financial Spread Betting an my experience. If you would be interested in reading through a copy of the manuscript and providing me with feedback and any errors that you may spot please e-mail me.

Untill next time

Disclaimer: Don’t take my posting of these trades as a recommendation that you should make the same trades!

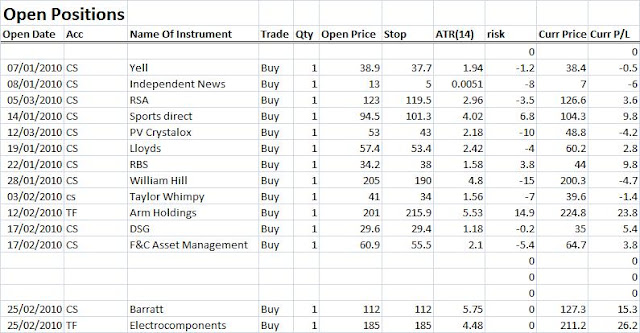

I have a little time to dedicate to spread betting today, so I thought I would take some time to write a proper update. Time has been very tight of late with moving house and all but we have found a new place to live and once we have settled in I should be able to update on a more regular basis so please bear with me.

I am going to summarise the last two weeks spread betting action on my account. You may have noticed that my open positions have changed over the last two weeks and here’s why. I have not manually closed any of my positions all of them have stopped out. This is part of my never clicking the buy or sell button manually. In my experience clicking the buy or sell button manually puts too much emotion in the spread bet which is the worst thing you can do. I have been in the situation where I wanted to take profit on a trade but when it came to clicking the button I couldn’t do it thinking it could make me more money and then the inevitable happens that prices change and you lose some of the profit you were going to take. This is why I always use stop orders. Used correctly they are the most powerful tool in the spread betters arsenal.

Spread Bets that Have Stopped Out in the Last Two Weeks

- Mitchells & Butler on 9-3-2010 at 275 = £7 loss

- Premier foods on 10-3-10 at 33.1 = £0.7 loss

- HMV on 18-3-10 at 74.7 = £3.7 profit

- SIG on 18-3-10 at 115 = £3.2 profit

- Beazley Group on 18-3-10 at 105.4 = £3.3 loss

I am not going to dissect how or why my positions have stopped out because frankly I don’t know the answer to those questions. The important thing is that the overall loss on these is small compared to my account size. Each is less than 1%. The ones that have stopped out for a profit do pose the question “Am I trailing my Stop too close?”. I have posted before that when I open a position and it goes into profit I trail my stop up by 2 ATR to break even then trail the stop at 3ATR. This is a strategy that I have employed on all of these positions however, it is a strategy that I have only just started to adopt so it may require some fine tuning. I like the idea of trailing my stop upto breakeven quickly but then should I allow for a 4 or 5 x ATR to give the position more room to breathe? This is a question that I will only find the answer to by trial and error. I think from now on I will trail by 4xATR and see how that goes. I know some people trail their stops by a percentage of price so 10% or 15%. This is probably an easier way to trail a stop as the maths are much simpler. I think for now I will try allowing my in profit positions stops to widen to 4xATR. I will not go through and adjust my current stop positions as this would mean I would revise some of the positions down which in teh spread betting world is a big no no. I never revise a stop to put myself in a worse position and I will not start now. I will let the profits increase to 4ATR and trail them upwards from there.

Spread Bets I Have Opened in the Last Two Weeks

- PV Crystalox on 12-3-10

I have only opened one new position over the last two weeks. I haven’t had much time to be looking for new trades but I did place one new trade when I had a little spare time. The position is PV Crystalox. I went long £1 per point at a price of 53.

If you look at the graph you will see prices have dropped to a new low on 10th Feb of 44.9. Since then they have started to trade sideways. When I placed the order I was unaware of the new sideways movement. On the 12th of March I seen the price had started to possibly start a new upwards movement passing the recent high on 18th Feb of 53 and then pulling back slightly. I decided this was a good time to enter the trade and place my order accordingly. I set my stop at 43 which is well below the recent low of 44.9. If this stop gets triggered I no longer want to be in the trade as the stock is making new lows. The stock has been trading down since mid 2008 and I think we will see the stock reverting to an uptrend soon an I am aiming to catch as much of that movement as possible.

That’s about all from me for now. Please bear with me as I will update the blog and pages more and more as I get more time over the coming weeks.

As always if you have any questions regarding anything on the blog please feel free to e-mail me.

Again I appologise for no other posts this week. Life for me is so crazy at the minute but it should be quietening down aroud mid April so I will have more time to post and will have more time to trade.

Here are my open positions

Sorry for not posting this week. Work and my personal life are just so busy at the minute. I am currently looking for a new place to live as we are moving because of my girlfriends job so it’s just crazy. Here are my latest open positions. I’ll try and post more next week. I also may have a new deal with CMC markets if you want to join with them. Watch this space for dtails.

I appologise for not posting yesterday. I will not be able to post until monday or tuesday next week now. Here is a summary of my open positions.

Disclaimer: Don’t take my posting of these trades as a recommendation that you should make the same trades!